No, the First Home Guarantee is not set to expire soon

What was claimed |

The verdict |

The First Home Guarantee may not be available after June 30, 2023. |

False. The government has indicated that 35,000 spots will be available in the next financial year under its program to help first home buyers. |

By Eiddwen Jeffery

A series of videos across social media platforms are creating a false sense of urgency for first home buyers to participate in a federal housing scheme, claiming that the scheme could end within months.

The videos were published by “Robbo”, a Perth-based mortgage marketing agent who acts as an intermediary for Australian home buyers and mortgage brokers.

In one video, which has received 59,000 views on Facebook, the agent tells first home buyers they “need to purchase” property before June 30 to “take advantage” of the remaining places under the scheme as it may not be continued after that time.

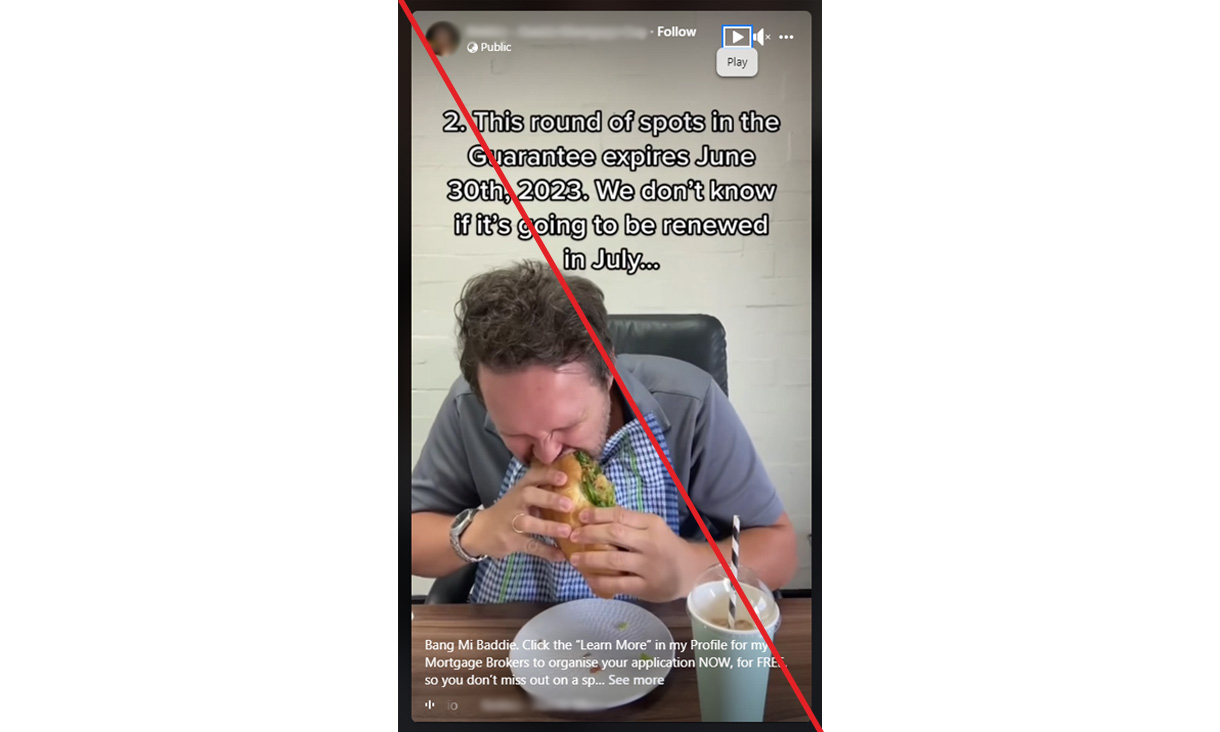

"This round of spots in the [First Home] Guarantee expires June 30th, 2023. We don't know if it's going to be renewed in July..." reads the text overlaid on the video.

Screenshot from video on social media

Screenshot from video on social media

But the claim is false. The government has indicated that the First Home Guarantee (FHBG) is set to continue beyond June 30, 2023 with another round of 35,000 spots to be made available.

The FHBG is a government housing initiative aimed at supporting prospective first home buyers through the National Housing Finance and Investment Corporation (NHFIC).

Under the policy, the NHFIC acts as guarantor for part of an eligible buyer’s home loan from a lender, allowing a buyer to purchase their first home with a minimum of 5 per cent deposit.

In March 2022 the Coalition government announced the Home Guarantee Scheme would be “expanded” from 10,000 guarantees for first home buyers to 35,000 places each financial year from 1 July 2022.

A spokesperson from the NHFIC Department told RMIT FactLab: “Under the current NHFIC investment mandate there are 35,000 places available under the First Home Guarantee in 2023/2024.”

The policy information guide also states: "From 1 July 2022, up to 35,000 home loans can be guaranteed under the FHBG in any financial year (ending 30 June).”

In the video, the mortgage marketing agent encourages buyers to participate in the FHBG before the government’s Help To Buy shared equity scheme begins inJuly 2023, giving the impression that it will replace the First Home Guarantee scheme.

“In July a new program is being released called the ‘help to buy’ scheme... but, the Gov will own up to 30% of your home under the ‘help to buy’ scheme, so take advantage of First Home Guarantee while spots are available", reads the video text.

However, the proposed shared equity scheme targets all prospective home buyers and will be separate from the FHBG.

More information on the FHBG and other funds under the Home Guarantee Scheme is available at the National Housing Finance and Investment Corporation.

The verdictWhile the current round of 35,000 spots for the First Home Guarantee will finish at the end of the current financial year, the scheme is set to continue into the next financial year with a further 35,000 government supported places.

|

Related News

Acknowledgement of Country

RMIT University acknowledges the people of the Woi wurrung and Boon wurrung language groups of the eastern Kulin Nation on whose unceded lands we conduct the business of the University. RMIT University respectfully acknowledges their Ancestors and Elders, past and present. RMIT also acknowledges the Traditional Custodians and their Ancestors of the lands and waters across Australia where we conduct our business - Artwork 'Sentient' by Hollie Johnson, Gunaikurnai and Monero Ngarigo.